THE CREDIT FOR CARING ACT:

What You Need to Know

Background: On May 17, 2017, this bi-partisan proposed bill introduced in the U.S. House and Senate called the Credit for Caring Act, (S.1151/H.R. 2505) would amend the Internal Revenue Code to create a federal, nonrefundable tax credit of up to $3,000 for family caregivers who work while also financially help and assist in caring for their parents, spouses, children with disabilities or other loved ones. Introduced by Senators Joni Ernst (R-IA), Michael Bennet (D-CO), Shelley Moore Capito (R-WV) and Elizabeth Warren (D-MA), and Representatives Tom Reed (R-NY) and Linda Sánchez (D-CA), this bill is an important step toward supporting caregivers that work while caring for family members. AARP and other national organizations have endorsed the Credit for Caring Act. This bill would help defray some of the costs to family caregivers, 78 percent of whom use their own money to assist with caring for a loved one, and help ensure that they can continue working.

Issue: Today, over 40 million Americans provide long term assistance and care for adult loved ones today. Unpaid caregiver costs are estimated to be valued at a staggering $470 billion dollars annually (more than total Medicaid spending in 2013). In addition, an estimated 3.7 million family caregivers provide care to a child younger than 18 with a medical, behavioral or other condition or disability, and 6.5 million family caregivers assist both adults and children. Family caregivers as-sist with necessary daily life functions, including bathing and dressing, preparing meals, manag-ing medications, driving to appointments, and managing finances. (Source: AARP 2016 Survey Report)

What will the Bill Do?

- The Bill would give eligible family caregivers the opportunity to receive a tax credit for 30 percent of the qualified expenses above $2,000 paid to help a loved one, up to a maximum credit amount of $3,000 if the caregiver meets the following criteria:

- Is a spouse, adult child, parent or another relation named under the “dependent” definition

- Helps a loved one, of any age, who meets certain functional or cognitive limitations or other requirements, as certified by a licensed health care practitioner

- May or may not live with the loved one

- Have more than $7,500 in earned income for the taxable year, and

- Can document qualified expenses.

- Index certain dollar amounts and income levels to inflation

- Coordinate with other existing tax provisions to prevent double dipping, and

- Phase out at higher income levels.

Status of the Bill:

This bill was referred to the House, Ways and Means Committee.

What You Can Do:

- Attend a Town Hall in your congressional district

- Contact Your U.S. Senator and House Representatives at www.senate.gov and www.house.gov

U.S. Capitol Switchboard (202) 224-3121.

You can download a copy of this article here: Credit for caring Act.pdf

OTHER NEWS

Financial Workshop Series

The Black Women's Agenda, Inc., under the sponsorship of The Coca-Cola Company and in collaboration with BWA National Collaborating Organizations, proudly presents its virtual learning series of Financial Workshops as a part of I Am the Change: Empowerment Through Economic Freedom. This three-part series, hosted by financial expert Martin Booker of AARP and featuring illustrious guest speakers, is designed to impart essential skills to help black women to unlock their financial potential and take charge of their economic well-being.

BWA AND COMMON CAUSE

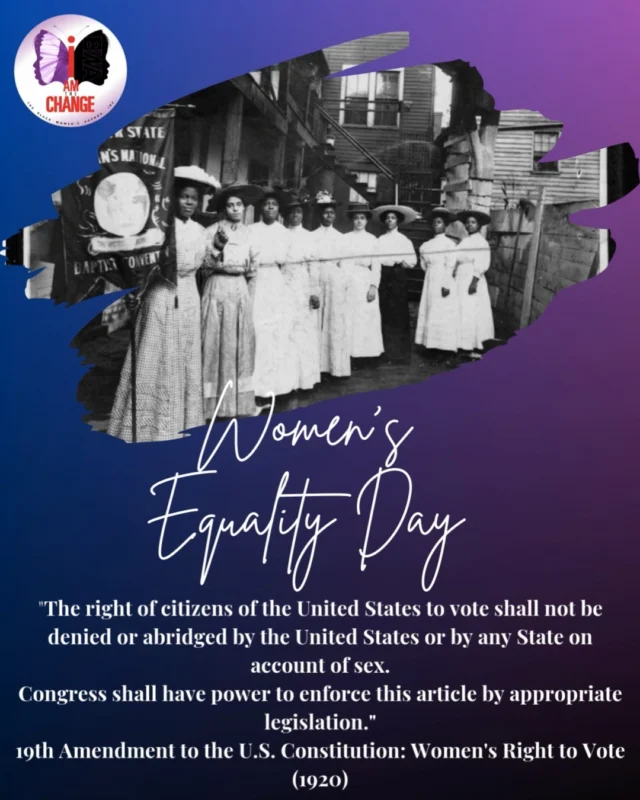

The Black Women’s Agenda, Inc. (BWA) has partnered with Common Cause, an organization fighting for an accountable government, equal rights / opportunities / representation and empowering voices in the political process to get out the vote and protect the vote. This partnership will allow individuals and organizations to expand their community outreach by ensuring that all voters have an equal opportunity to vote and have that vote count.

The Election Protection Program provides Americans from coast to coast with comprehensive information and assistance at all stages of voting – from registration, to absentee and early voting, to casting a vote at the polls, to overcoming obstacles to their participation.

I Matter: I Vote BWA 43rd Symposium Town Hall

WASHINGTON, DC – Friday, September 18, 2020 – The Black Women’s Agenda, Inc. (BWA) went on the offensive today, hosting a virtual town hall devoted to protecting and securing the voting rights of African Americans and other people of color during its 43rd Annual Symposium. Moderated by Heather McGhee, Board Chair, The Color of Change, a panel of prominent political activists and observers – including Rev. Dr. William J. Barber II, President, Repairers of the Breach and Co-chair, Poor People’s Campaign; Dr. Johnetta B. Cole, anthropologist, educator and Board Chair of The National Council of Negro Women, Inc.; Dr. Eddie S. Glaude Jr., an esteemed author, commentator and Chairman of Princeton University’s Department of African-American Studies, and Aisha C. Mills, a nationally renowned political strategist and social impact advisor – discussed strategies for combatting voter suppression, registering and engaging African-American voters, and ensuring that they have the opportunity to make their voices heard.

© 2025 The Black Women’s Agenda, Inc. All Rights Reserved. Privacy Policy